Our market is facing changes every day. Many new things develop over time and the whole scenario can alter in only a few seconds. Such changes occur constantly, and any organization that fails to identify and respond to them runs the risk of encountering business problems or even the failure of the entire enterprise.

Environmental analysis is a strategic tool. It is a process to identify all the external and internal elements, which can affect the organization’s performance. Two techniques are used to examine the business environment within which an organization is operating: PESTLE analysis and Porter’s Five Forces analysis.

The analysis of the external environment should be an ongoing process for senior management, since the factors identified may provide insights into problems for the future or opportunities for new successes. Thus, senior management should carry out regular monitoring of the business environment to identify any influences that may require action.

Using the PESTLE and five forces techniques together help to provide a detailed picture of the situation facing an organization. Just using one technique may leave gaps in knowledge and understanding.

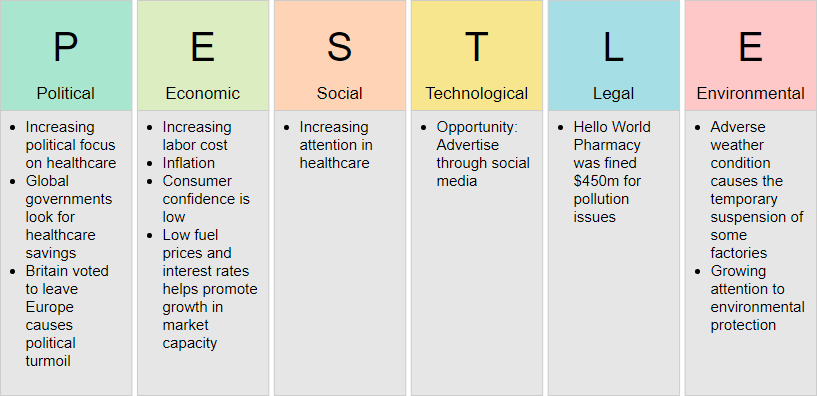

The figure below shows a PESTLE Analysis example of a pharmaceutical company. PESTLE is a varied form of PEST. It has two additional columns L and E for listing the Legal and Environmental factors.

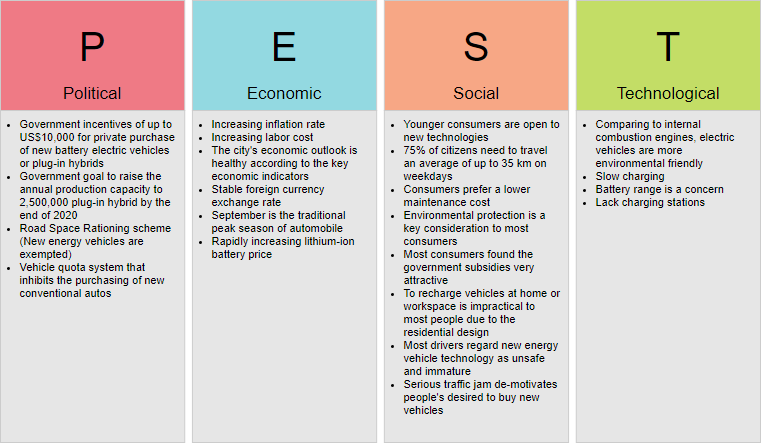

The basic PEST analysis includes four factors:

Political factors relate to how the government intervenes in the economy. Specifically, political factors have areas including tax policy, labor law, environmental law, trade restrictions, tariffs, and political stability. Political factors may also include goods and services which the government aims to provide or be provided (merit goods) and those that the government does not want to be provided (demerit goods or merit bads). Furthermore, governments have a high impact on the health, education, and infrastructure of a nation.

Economic factors include economic growth, exchange rates, inflation rate, and interest rates. These factors greatly affect how businesses operate and make decisions. For example, interest rates affect a firm’s cost of capital and therefore to what extent a business grows and expands. Exchange rates can affect the costs of exporting goods and the supply and price of imported goods in an economy.

Social factors include the cultural aspects and health consciousness, population growth rate, age distribution, career attitudes and emphasis on safety. High trends in social factors affect the demand for a company’s products and how that company operates. For example, the aging population may imply a smaller and less-willing workforce (thus increasing the cost of labor). Furthermore, companies may change various management strategies to adapt to social trends caused by this (such as recruiting older workers).

Technological factors include technological aspects like R&D activity, automation, technology incentives and the rate of technological change. These can determine barriers to entry, minimum efficient production level and influence the outsourcing decisions. Furthermore, technological shifts would affect costs, quality, and lead to innovation.

The figure below shows a PEST Analysis example of the new energy vehicles industry.

Expanding the analysis to PESTLE To Cater the External Factors:

Legal factors include discrimination law, consumer law, antitrust law, employment law, and health and safety law. These factors can affect how a company operates, its costs, and the demand for its products.

Environmental factors include ecological and environmental aspects such as weather, climate, and climate change, which may especially affect industries such as tourism, farming, and insurance. Furthermore, growing awareness of the potential impacts of climate change is affecting how companies operate and the products they offer, both creating new markets and diminishing or destroying existing ones.

NiceWare is a leading Footwear company that operates in the athletic apparel industry.

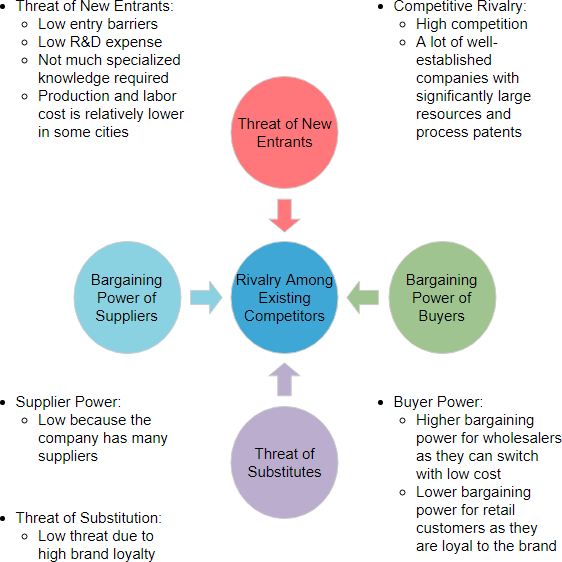

Based on Porter’s Five Forces model the threat of new entrants is moderate as there are high capital costs, mostly related to advertising and promotion, especially when a new product line is launched. On the other hand, company A can expand in the performance apparel industry and cross-sell its products.

The bargaining power of suppliers is relatively low because the company has many different suppliers both in the US and abroad.

The bargaining power of customers is higher in the wholesale customers as they can switch at a low cost to the competition, thereby gaining a higher margin. Concerning the retail customers, the bargaining power is lower as customers are loyal to the brand.

The threat of new entrants is high as the entry barriers are low – low R & D expense, not much-specialized knowledge is required in operating the business, low production and labor cost in some cities.

The threat of substitute products is relatively low because brand loyalty is high. Hence, the demand for the company’s products is expected to continue in the long-term.

The competitive rivalry in the industry is high as there are a lot of well-established companies with significantly larger resources and process patents.

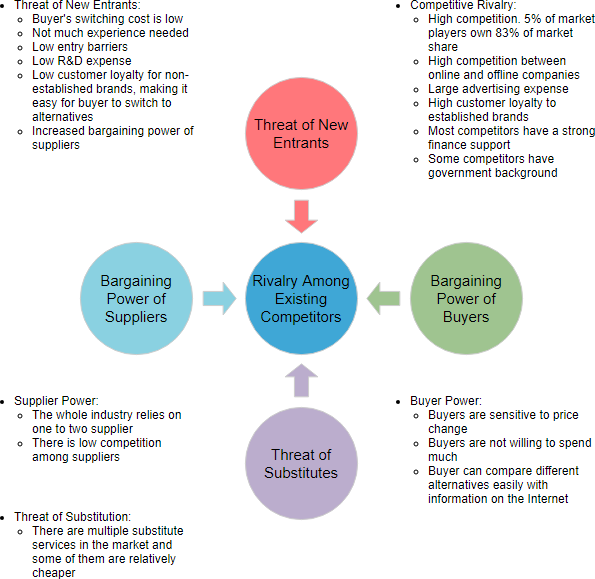

These forces are neatly brought together in a diagram below:

The figure below shows another Five Forces Analysis diagram example of a vacuum cleaner company.